Hey everyone, let’s dive into some seriously interesting stuff happening at the intersection of Trump Tariffs, politics, economics, and global trade right now! We’re talking about the big players: Donald Trump, China’s Xi Jinping, and arguably one of the most crucial financial institutions in the world, the U.S. Federal Reserve, headed by Jerome Powell. There’s a high-stakes drama unfolding, and it seems like everyone is trying to figure out who’s going to blink first.

The “Mad King Trump” and the Tariff Tangle

So, picture this: it’s late March 2025, and American economist Noah Smith drops a thought-provoking article on his personal blog called “The Latest Episode of Mad King Trump.” Now, Smith starts off by saying he doesn’t actually believe the claims that Donald Trump is a secret Russian agent trying to wreck America’s economy and global standing. That’s a pretty wild thought, right? But here’s the kicker: Smith immediately follows up by saying that, despite not believing that theory, he honestly can’t tell the difference between what Trump is actually doing and what an enemy spy would do if they were sitting in the Oval Office, trying to damage the U.S.

Smith then went on to list the reasons why he believes Trump’s policies are actually harming America and, perhaps unintentionally, helping out its adversaries. And guess what was high on that list? You got it – tariffs !

Just a few days after Smith’s article came out, almost as if on cue to prove his point that Trump’s moves might hurt the U.S., Trump announced something pretty controversial: his “Liberation Day ” plan. This plan involved slapping what the sources call “exaggerated customs tariffs” on practically the entire world. It sounded pretty drastic. But, under pressure from the bond market – see, even presidents have to listen to the markets sometimes! – Trump later backed off a bit. He decided to suspend these hefty tariffs for 90 days, but here’s the crucial part: he specifically excluded China from this suspension.

Read Also : How Microsoft Employees Are Supporting Israel’s Military

Putting the Squeeze on China (and China Pushes Back)

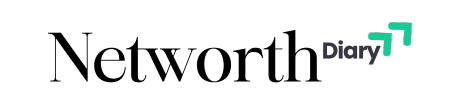

This wasn’t just a random decision; it was a deliberate move by Trump to escalate his trade war , specifically targeting China and the Chinese people. The source suggests that Trump was likely counting on China quickly backing down and asking to negotiate. That seems like a reasonable assumption if you’re trying to force someone’s hand.

However, China did not play along. On their side, the Chinese announced they were refusing to back down and threw the challenge right back. They responded with similar escalatory measures. We’re talking about them raising their tariffs on American goods to 125% ! Chinese President Xi Jinping wasn’t just responding with tariffs; he also made public statements, effectively saying China would defy Trump and wasn’t afraid of his actions. Xi specifically mentioned that China’s development over 70 years has relied on self-reliance and hard work, never external aid. He powerfully stated, “We are not afraid of any unjust suppression.”

According to White House Press Secretary Caroline Leavitt (as quoted in one source on April 15, 2025), Trump sent a message to China saying the ball is now in China’s court. Trump’s message emphasized that China needs a deal with the U.S., not the other way around, because China needs American consumers and money. Leavitt noted that this message, which Trump personally gave her, reflects his frustration and despair over Xi Jinping’s approach to the trade war. Xi’s approach? A calm defiance, which seems to be annoying Trump. Xi doesn’t appear to be in a hurry to end the war, unlike what Trump hoped.

Henrietta Levin , a former deputy director for China Affairs at the State Department during the Biden administration, shared her prediction that Trump’s efforts to pressure China into negotiations wouldn’t work. Levin told Politico that strategic decisions in China are mainly made by one person, President Xi Jinping . She noted that Xi is very focused on his political dignity and China’s national greatness, which seems to outweigh any tactical considerations.

So, Trump is in a tight spot. He probably expected China to come running to the negotiating table. But with China standing firm and refusing to surrender or back down first, Trump is left with two main options:

- He could retreat first. This would be a huge blow to his political and personal pride.

- He could double down, stick to his guns, and keep the challenge going with China, betting that they will collapse before he does. The problem with this option? It will likely get the U.S. economy tangled up in a messy mix of inflation and recession.

It’s become a real game of chicken between the two biggest economies in the world. According to sources, Trump is refusing to initiate talks and has told U.S. officials that China must take the first step because they responded to his tariffs. People close to Trump reportedly see Xi calling Trump as the key to resolving the crisis, but they understand Xi’s refusal to do so because he doesn’t want to appear weak. Meanwhile, Chinese President Xi Jinping is also refusing to be the first to initiate communication. Both leaders are basically in a stalemate, waiting for the other to make the first move.

Trump Calls for a Lifeline: The Fed?

Even if Trump sometimes acts like an emperor or, as Noah Smith put it, a “mad king,” he doesn’t have absolute control over the U.S. economy. There are independent institutions that are supposed to operate outside the President’s direct command, like the Federal Reserve .

The sources suggest that Trump likely believes the Fed is the institution that can bail him out of the mess he created by launching this big trade war with China without fully considering the consequences. How would the Fed do that in his eyes? Simply put, Trump thinks the Fed can boost economic growth by adopting a more expansionary policy. This typically means two things: lowering interest rates and increasing the amount of money (liquidity) flowing through the economy.

Read Also : The Financial Order of Operations: Your Step-by-Step Guide to Financial Freedom

The Clash with “Toilet” Powell

This brings us to the direct conflict between Trump and the current Fed Chair, Jerome Powell . Just days before the reports we’re looking at, Trump reportedly attacked Powell and threatened to fire him. Why? Because Trump had asked Powell to lower interest rates, believing this would help him stand strong against China.

The attacks didn’t stop there. On April 17th, Trump posted on Truth Social (according to the source), comparing Powell negatively to the European Central Bank , which was expected to lower rates for the seventh time. Trump reportedly called Powell “Toilet” and claimed he’s “always late and wrong.” He further criticized a Fed report as “catastrophic” and demanded that Powell lower rates like the European Central Bank has been doing. Trump concluded that post by saying, “Firing Powell cannot come soon enough.”

This wasn’t the first time Trump made such demands. A few days earlier, on April 4th, just two days after the “Liberation Day” plan, Trump posted that the Fed needed to lower rates and stop “playing politics.” Reports from the Wall Street Journal revealed that Trump had actually been talking about the possibility of firing the Fed Chair for months.

Powell Stands His Ground

Despite the pressure and insults, Jerome Powell has clearly pushed back. Even without naming Trump directly during an appearance at the Economic Club of Chicago on April 16th, Powell challenged the President. He stated unequivocally that the independence of the Fed is a legal matter. He said that they would not be affected by any political pressure. In his words, “Anyone can say what they want, there’s no problem, but we in the Fed will do our work strictly, unaffected by any political considerations or any other external factors.”

Powell also used that appearance to highlight the difficult situation Trump’s policies have created for the Fed and the U.S. economy. He specifically mentioned that tariffs would likely lead to higher unemployment because the economy would slow down. He also pointed out that tariffs would probably contribute to inflation , as consumers would inevitably bear some of the cost.

Understanding the Fed’s Role (and Why It’s Hesitant)

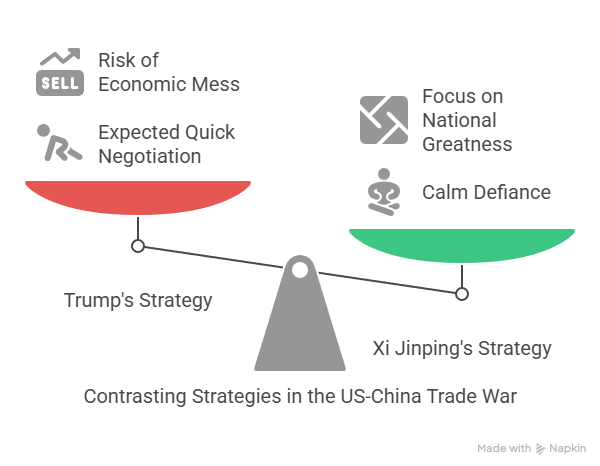

To understand this conflict, it’s helpful to know what the Federal Reserve is actually tasked with. The sources explain that the Fed’s main job is to keep inflation close to 2% annually and to achieve the highest possible rate of employment. Their primary tool to achieve this is controlling interest rates . When inflation is high, the Fed typically raises rates to pull money out of the economy and cool things down. But they have to do this carefully to avoid hurting economic growth, investment, and employment.

And honestly, the Fed, under Powell, has had some success recently. Inflation, which hit 9% in June 2022 , had come down significantly to 2.4% by March 2025 , getting pretty close to that 2% target. As inflation got closer to their target, the Fed actually did start cutting rates. They made a big cut of 50 basis points in September 2024, followed by 25 points in November and another 25 in December. But then? They stopped. The main interest rate has been held steady in the range of 4.25% to 4.5% since the end of last year.

So, why the pause? Why isn’t the Fed doing what Trump wants? The simple answer, according to the sources, is Trump himself. The Fed is genuinely worried about the potential for Trump’s policies, especially the tariffs, to cause inflation. Their fear is that if they lower interest rates (which increases the money supply and liquidity) at the same time that Trump’s actions are causing prices to rise, inflation could easily spin out of control. This concern only grew after Trump announced the “Liberation Day” tariffs in early April, which were reportedly worse than expected.

Essentially, Trump wants the Fed to adopt an expansionary monetary policy – lower rates, pump money into the economy – to counteract the negative effects of his trade war. But Powell is clearly opposing this, standing firm on the central bank’s independence and ignoring Trump’s wishes.

The Real Cost of Trump Tariffs

Powell isn’t the only one pointing out the negative impacts of the tariffs. Estimates from the Budget Lab at Yale University suggest that the current tariffs could cost the average American household about $4,900 per year due to higher prices. Plus, when Trump announced the controversial tariffs, American financial markets took a hit, losing trillions of dollars in market value. Various polls also indicate that most Americans are against Trump’s tariffs, believing they hurt the economy and consumers through higher prices and potentially increased unemployment.

While Trump has been successful in bringing much of the government and Congress in line, largely because people are reportedly afraid of his reactions, there are three important groups outside his direct control: the public/consumers, the financial markets, and the Federal Reserve .

The Structure and Independence of the Fed: A Legal Hurdle

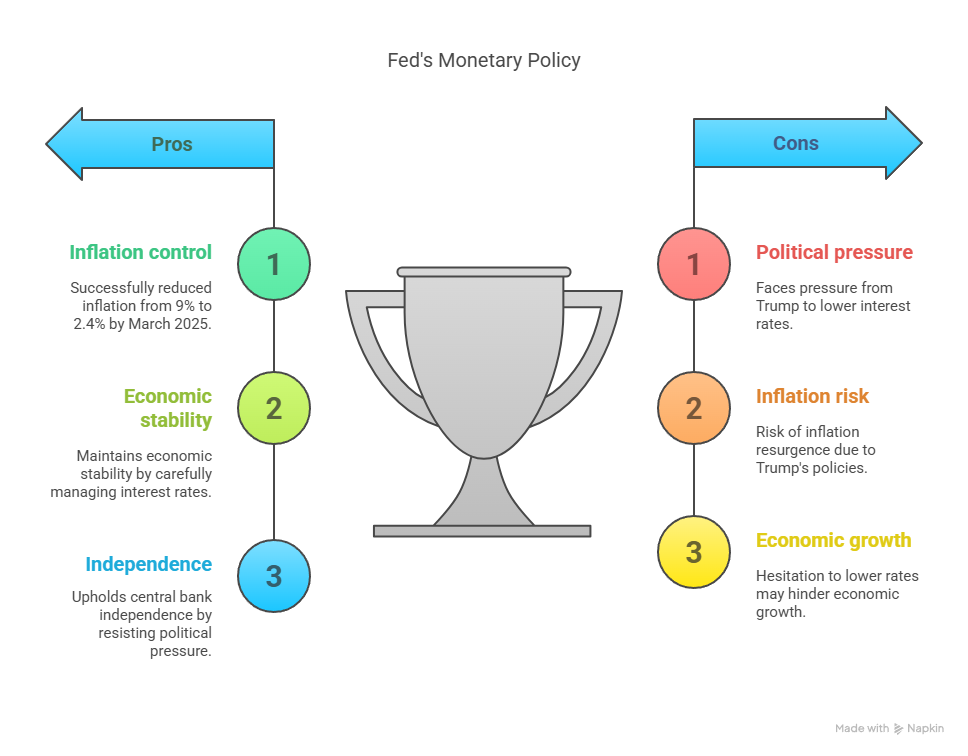

Threatening to fire the Fed Chair is a big deal. In fact, no U.S. President has ever actually removed a Fed Chair. There are a couple of reasons for this. First, most presidents have generally respected the Fed’s independence, even if they disagreed with its policies behind the scenes. Second, and perhaps more importantly, firing a Fed Chair is legally very, very difficult.

Let’s quickly look at how the Fed is structured, as described in the sources. The system includes:

- The Board of Governors : This is made up of seven members. The President of the U.S. nominates them, and the Senate has to confirm them. They serve for a whopping 14 years, and their terms can’t be renewed.

- The Chair and Vice-Chair : These positions are selected from the seven members of the Board. The President nominates them, and the Senate confirms them for 4-year terms. Jerome Powell took the Chair role in 2018 (nominated by Trump) and was reappointed by Biden in 2022. His current term as Chair ends in January 2026.

- The Federal Open Market Committee (FOMC) : This is the group that actually makes the key decisions about interest rates and monetary policy. It’s made up of all seven members of the Board of Governors plus five of the twelve presidents from the Federal Reserve Banks. The President of the New York Fed is always one of these five.

Now, about firing the Chair or a Board member: The law allows for removal “for cause.” U.S. courts have typically interpreted “for cause” to mean things like misconduct or being unable to do the job. Disagreeing with monetary policy decisions is not considered a “just cause.” This makes any attempt by Trump to fire Powell before his term is up very complicated legally.

Adding to this complexity, none of the current members of the Board of Governors have terms ending soon enough for Trump to replace them with someone more loyal to him. So, the current group is likely staying put at least until January 2026.

The FOMC, the rate-setting committee, meets eight times a year. They’ve already met twice in 2025 – in late January and mid-March. Both times, they decided not to lower interest rates, keeping them in that 4.25% to 4.5% range.

The Next Meeting and the Fed’s Quandary

Trump is pressuring the Fed to cut rates at their May 6–7 meeting. While a cut might make economic sense, the Fed fears it would appear politically motivated, risking its independence. Such a perception could undermine investor confidence and destabilize both the U.S. and global economies.

The source argues that Trump’s actions – attacking the Fed, trying to undermine its independence, wanting it to be a subservient body following his orders – are, frankly, destroying one of the most important institutions that has contributed to the prosperity and development of the American financial system over the last century. While Trump might not be able to fire Powell, even trying could shatter the remaining trust in the U.S. economy and its financial system, much of which the source claims Trump has already damaged recently.

A Blast from the Past: The Original Battle for Fed Independence

To really appreciate the significance of this standoff, it’s worth looking back. The sources share a great story about William McChesney Martin , a former Fed Chair who became a symbol of the institution’s independence. Back in 1951, when President Harry Truman was thinking about appointing Martin, Truman reportedly asked him if he would promise not to raise interest rates. Martin’s response was classic and speaks volumes about the Fed’s role: “Mr. President, unless your administration pursues responsible fiscal and monetary policies, interest rates are likely to rise again. The markets will not wait for kings or prime ministers or presidents or treasury secretaries or chairmen of the Federal Reserve Board.” ( Read this article for more infos)

Martin got the job and, despite Truman’s displeasure, did indeed raise rates to fight inflation. Truman was apparently furious and stopped talking to him much. Martin recounted running into Truman and his companions years later in New York; he greeted the President, but Truman just looked him in the eye, said one word – “Traitor!” – and walked away. Yet, Truman, and the presidents who followed him, never tried to remove Martin. They respected the office’s independence. Martin stayed on as Fed Chair for nearly 19 years, serving under five presidents. That’s why he’s seen as a symbol of Fed independence, setting an example for chairs like Powell.

Trump, according to the sources, wants Powell to rescue him in his confrontation with China. But Powell seems more focused on a different kind of rescue: saving the American economy from the unprecedented threat posed by Trump’s policies.

| Topic | Details |

|---|---|

| Next Fed Meeting | Scheduled for May 6–7. Trump is pressuring the Fed to cut interest rates. |

| Fed’s Concern | Cutting rates might appear politically motivated, risking the Fed’s independence. |

| Potential Risks | If investors lose confidence in the Fed, it could harm both the U.S. economy and the global economy. |

| Trump’s Actions | Attacks on the Fed and efforts to undermine its independence are seen as damaging to long-term economic stability. |

| Historical Context | William McChesney Martin defended Fed independence in 1951 against pressure from President Truman. |

| Martin’s Stand | Martin refused to promise Truman he wouldn’t raise rates, emphasizing that markets “will not wait for kings or presidents.” |

| Impact of Martin’s Example | Martin’s 19-year tenure across five presidents is now a symbol of Fed independence, influencing leaders like Jerome Powell today. |

| Current Parallel | Trump wants Powell to boost the economy amid the trade war with China, but Powell prioritizes protecting economic integrity over political pressure. |

China’s Hidden Strengths in the Standoff

In this high-speed game of chicken, President Xi Jinping actually holds some advantages that Trump might envy:

- Internal Support : Trump’s aggressive approach has made the trade war a matter of national dignity for ordinary Chinese citizens. Because of this, they might be more willing and able to tolerate the economic difficulties that come with it compared to the American public. Many Americans, on the other hand, reportedly feel Trump unnecessarily dragged them into a global crisis and don’t view the struggle with China through the lens of national dignity.

- State Control : As the leader of a largely totalitarian state, Xi has nearly absolute control over the institutions involved in the trade war, including the People’s Bank of China (their central bank). This isn’t the case for Trump, who, despite trying to assert control over various U.S. institutions, faces resistance from long-established bodies like the courts, universities, and, significantly, the Federal Reserve, which are quite capable of resisting his wishes.

- Time : Xi’s firm control over state institutions and the Chinese public’s view of the trade war as a matter of national dignity give him the luxury of patience. He can afford to wait calmly without feeling pressured to change his position with Trump. Trump, lacking this level of absolute control and facing potential backlash from markets, consumers, and the Fed, doesn’t have the same luxury.

The Real Way Out

Ultimately, the sources suggest that pumping more money into the economy or lowering interest rates isn’t the actual solution to the economic jam the U.S. is in right now. The clear way out, according to this perspective, is for Trump to simply reverse the very actions that caused the problem in the first place – the tariffs .

Right now, it seems Trump isn’t ready to do that, at least not in his fight with China. But the sources argue he’ll have to eventually; there’s no getting around it.

Who Blinks First?

So, here we are. Trump is facing down China in a trade war, expecting them to fold, but they’re standing firm. He’s simultaneously demanding the Federal Reserve rescue the U.S. economy, but the Fed Chair, Jerome Powell , is resisting, prioritizing the Fed’s independence and stability over political demands, especially when those demands might exacerbate the problems caused by the tariffs. It’s a standoff on multiple fronts.

The core question the sources leave us with, and perhaps the million-dollar question for the global economy right now, is this: In this high-stakes game of chicken, who will back down first? Will it be Trump, who needs an economic win but faces limits from independent institutions and public opinion? Or will it be Xi Jinping , who seems to have stronger internal support and more centralized control, giving him the ability to wait?

It’s a fascinating and, frankly, a little bit worrying situation to watch unfold. What do you think? Who is more likely to make the first move? Let’s keep an eye on how this develops!

Read Also : Can I Trade In a Financed Car? Your Essential 2025 Guide