Retirement planning often feels like solving a puzzle with missing pieces. Between rules of thumb, market uncertainty, and shifting retirement goals, it’s easy to get lost. Enter the $1,000-a-month rule—a straightforward strategy to build a retirement nest egg. But is this popular strategy right for everyone? Let’s explore its mechanics, advantages, and gaps while weaving in actionable insights for your personal situation.

Understanding What is the $1000 a month rule for retirement?

The $1,000-a-month rule is a retirement savings guideline suggesting that saving $1,000 monthly can create a reliable income stream for life during retirement. This rule of thumb simplifies complex calculations, such as withdrawal rates and annual expenses, into an easy-to-follow piece of wisdom.

For example, if you start at age 30 and save $1,000 monthly until retirement age (typically 65), compounding could grow your contributions into a substantial retirement nest egg. But while this method avoids oversimplifying things, it’s still a generalized benchmark. Let’s break down the math.

The Mathematics Behind the Rule

How Compounding Fuels Retirement Investments

Compound growth is the backbone of long-term wealth. By consistently investing $1,000 monthly, your money earns returns that generate their own returns. Assume a 7% annual return (historically aligned with the stock market):

| Years Invested | Total Contributions | Estimated Value |

|---|---|---|

| 25 | $300,000 | $830,000 |

| 35 | $420,000 | $1.8 million |

| 40 | $480,000 | $2.7 million |

Assumes 7% annual return, monthly contributions. Use a retirement calculator for personalized projections.

This growth hinges on market conditions. A stock market downturn or bond market volatility could alter outcomes, emphasizing the need for a balanced portfolio.

Estimating Your Retirement Savings Target

The rule assumes a 4% annual withdrawal rate—a sustainable withdrawal rate for a 30-year-long retirement. A 1.2 million nest egg provides 48,000 yearly ($4,000 monthly), supplementing Social Security. However, annual inflation (averaging 3%) and unexpected expenses (like health insurance) can strain this model.

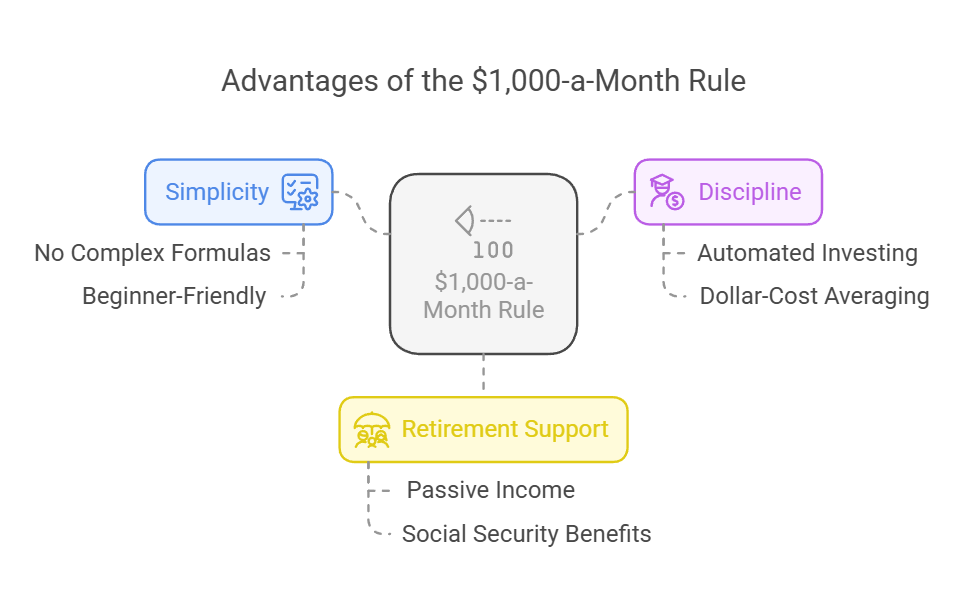

Advantages of the $1,000-a-Month Rule

Simplicity for All Financial Situations

No complex formulas or career in finance are required. This personal finance rule encourages consistent cash flow into retirement accounts, making it a perfect method for beginners.

Builds Discipline and Financial Success

Automating $1,000 monthly fosters habits that withstand economic downturns. Regular investing smooths market uncertainty through dollar-cost averaging.

Supports a Comfortable Retirement

Paired with passive income (like rental properties) and Social Security’s monthly retirement benefits, this strategy can sustain a fulfilling retirement lifestyle. According to Net Worth Diary, even a $500k net worth offers security—imagine multiplying that.

Limitations of the $1,000-a-Month Rule

Overlooks Key Retirement Expenses

The rule doesn’t account for rising healthcare costs, lifestyle inflation, or state-specific prices. For example, median home prices in California versus Kansas drastically affect monthly expenses.

One-Size-Fits-All Falls Short

A 30-year-old’s retirement plans differ from a 50-year-old’s. Younger savers benefit from aggressive portfolios (like a mix of stocks), while older investors may prioritize safe money options.

Alternatives to Consider

Percentage-Based Savings Rate

Save 15-20% of your income. This scales with earnings and aligns with financial planning best practices.

Retirement Savings Calculators

Tools like Fidelity’s planner factor in asset allocations, cash reserves, and even crypto market trends for a complete retirement strategy.

Social Security’s Role in Retirement Income

Maximizing Monthly Retirement Benefits

The average 2024 Social Security check is $1,907. While helpful, it’s rarely enough alone. Use the SSA’s calculator to estimate your benefits and adjust your savings rate.

Bridging the Income Gap

If Social Security covers 40% of your pre-retirement income, your nest egg must fill the rest. For a 6,000 monthly budget, aim for 3,600 from savings.

Balancing Risk and Reward in Investments

Diversify Your Asset Base

- Stocks: High growth but volatile.

- Bonds: Stability during bear markets.

- Real Estate: Rental properties generate passive income.

A 60/40 mix of stocks and bonds is a common retirement goal.

Adjust for Market Uncertainty

Revisit your portfolio balance annually. If the stock market dips, consider catch-up contributions to stay on track.

Crafting Your Personalized Retirement Plan

Calculate True Income Needs

Track current monthly expenses and add 20% for leisure. If you spend 5,000now,aimfor5,000now,aimfor6,000 in retirement.

Address Inflation and Taxes

Factor in annual inflation (3%) and tax return implications. For instance, Roth IRA distributions are tax-free, unlike traditional retirement accounts.

Bridging Gaps in Your Savings

Identify Shortfalls Early

Compare your projected retirement savings target to your needs. Use a net worth tracker to spot gaps.

Explore Additional Income Sources

- Side Hustles: Freelancing or consulting.

- Passive Income: Dividend stocks or life insurance products.

Why Expert Advice Matters

Collaborate With Financial Advisors

A fiduciary financial planner optimizes asset allocations, tax strategies, and withdrawal rates. Firms like Baird Private Wealth Management tailor plans to your personal situation.

Customize for Your Life

Your health, family needs, and retirement age shape your strategy. For example, what’s considered a “rich” net worth varies by location and goals.

Final Thoughts

The $1,000-a-month rule is a solid starting point, but retirement planning demands flexibility. Adapt your investment plans to market shifts, lifestyle changes, and expert advice. Whether you’re eyeing a modest retirement nest egg or aiming for a luxurious retirement lifestyle, proactive steps today ensure peace of mind tomorrow.

For more insights, explore financial freedom strategies and refine your retirement roadmap.

FAQs

1. What is a respectable net worth?

A respectable net worth varies depending on age, location, and lifestyle. Generally, having enough assets to cover living expenses and future retirement needs is considered respectable.

2. What percentage of retirees have $2 million dollars?

The percentage of retirees with $2 million or more is relatively small, as most retirees have less than $1 million saved. This percentage varies depending on sources and demographics.

3. What net worth is considered rich?

In the U.S., a net worth of $2 million or more is typically considered wealthy, though perceptions of wealth can vary based on location and personal circumstances.

4. Does a 401(k) count as net worth?

Yes, a 401(k) is included in your net worth, as it represents assets that contribute to your overall financial value.

5. What is the net worth of the top 5%?

The top 5% of U.S. households typically have a net worth of approximately $3 million or more.

6. How much should I have in my 401(k) by age 38?

A common benchmark is to have 1.5 to 2 times your annual salary saved in your 401(k) by age 38.

7. How much net worth do you need to live comfortably?

Living comfortably often requires a net worth that can generate enough income to cover expenses. For retirement, many aim for at least $1 million to $2 million, depending on lifestyle and location.

8. What is the average American net worth?

The average American household net worth is around $1 million, while the median is much lower, reflecting wealth inequality.

9. What is the upper-class income?

Upper-class income in the U.S. typically starts at around $150,000 per year for individuals and is higher for households.

10. What is a good net worth to retire?

A good net worth for retirement depends on lifestyle, location, and expected expenses. Many financial experts recommend having at least $1 million to $2 million saved.

11. What percentage of Americans are millionaires?

Approximately 8% to 10% of American households have a net worth of $1 million or more.