Life insurance isn’t just about protecting your loved ones after you’re gone; it can also be a dynamic tool for financial growth and security. Think of it as more than just a safety net—it’s a way to protect your assets, boost your wealth, and plan for a comfortable future. Let’s dive into some life insurance hacks that can help you make the most of your financial planning.

Understanding Asset Protection and Preservation

First, let’s clarify two key concepts: asset protection and asset preservation.

Asset Protection

Asset protection is all about setting up legal safeguards to keep your assets out of reach from potential creditors. It’s like building a fortress around your valuables to protect them from lawsuits or other financial threats.

- Limited Liability Companies (LLCs): These can shield your personal assets from business debts and lawsuits.

- Limited Partnerships (LPs): Similar to LLCs, LPs offer protection and can be particularly useful for real estate investments.

- Asset Protection Trusts: These trusts provide a strong layer of defense, especially for high-net-worth individuals.

Asset Preservation

Asset preservation, on the other hand, focuses on growing your wealth and planning for different life stages, like retirement or needing long-term care. It’s about making smart financial decisions to ensure your wealth lasts as long as you do.

Learn more about achieving financial freedom in 2025.

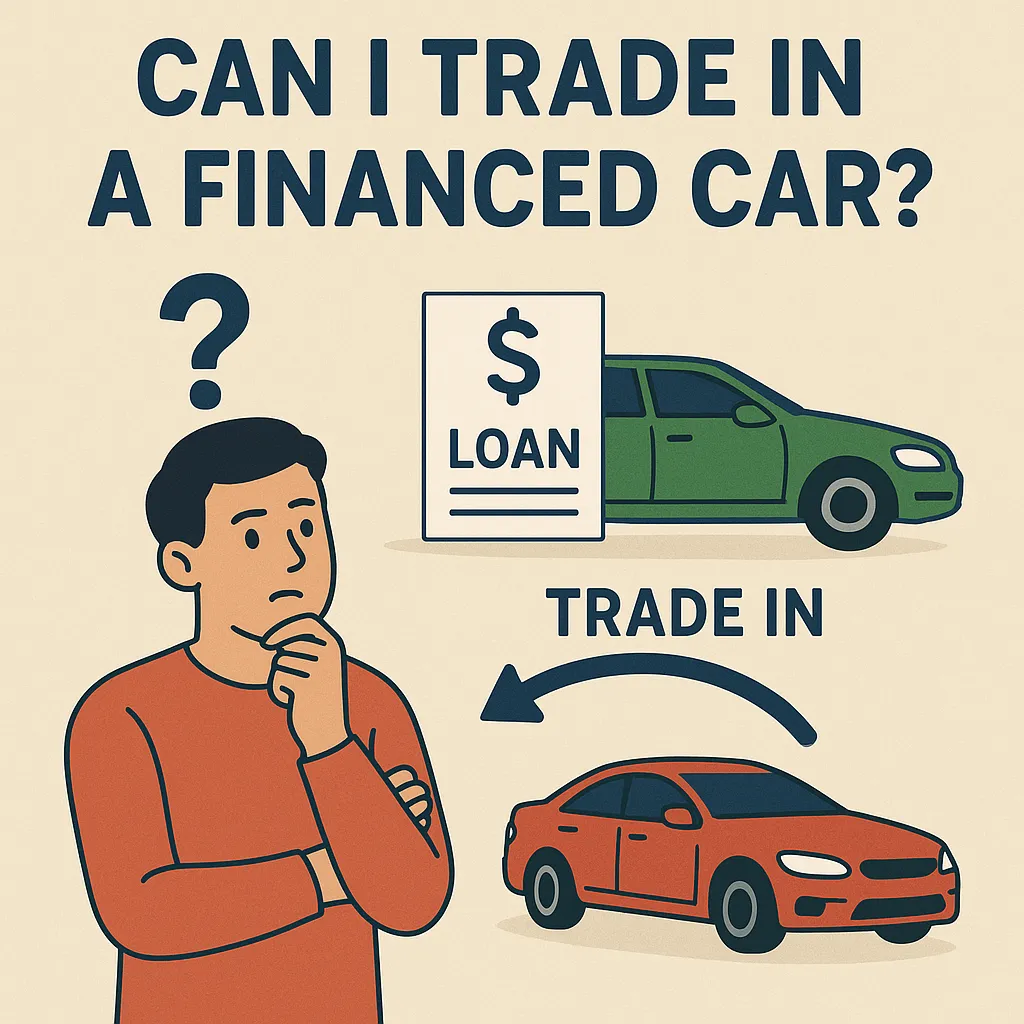

Navigating Long-Term Care with Medicaid-Compliant Annuities

One of the biggest financial challenges many face is long-term care. The costs can be truly staggering.

The High Cost of Care

- On average, in-home care costs around $3,000 a month, while a nursing home can run upwards of $15,000 per month.

Medicaid Compliant Annuities to the Rescue

This is where Medicaid-compliant annuities come in. These little-known tools can help you qualify for Medicaid while still protecting a significant portion of your assets.

- How They Work: These annuities convert a lump sum into a regular monthly income stream. This helps you meet Medicaid’s eligibility requirements without depleting all your savings.

The Five-Year Look-Back Period

Medicaid takes a close look at any asset transfers you’ve made in the five years leading up to your application.

- To avoid penalties, consider transferring assets into a Medicaid asset protection trust well in advance.

Avoiding the Penalty Box

- If you gift assets to family members to qualify for Medicaid, you might face a penalty period during which you won’t receive benefits.

- A Medicaid compliant annuity can act as a financial bridge, covering expenses during this waiting period.

IULs: The Secret Weapon for Tax-Advantaged Growth

Let’s talk about Indexed Universal Life Insurance, or IULs. These policies combine life insurance coverage with the potential for serious cash value growth, all while offering some sweet tax advantages.

Term vs. Permanent Life Insurance

- Term Life Insurance: Covers you for a specific period, like 10 or 20 years. It’s often cheaper, but it doesn’t build cash value. Once the term is up, so is your coverage.

- Permanent Life Insurance: Includes whole life and IUL policies, offering lifelong coverage and a cash value component that grows over time.

Whole Life vs. IUL

| Feature | Whole Life Insurance | IUL (Indexed Universal Life) Insurance |

|---|---|---|

| Premiums | Fixed premiums for life | Flexible premiums within certain ranges |

| Growth Rate | Fixed, predetermined rate set by the insurance agency | Linked to the performance of a stock market index (e.g., S&P 500) with floors and caps |

| Cash Value Access | Can access while living | Can access while living |

| Market Risk | No direct market risk | Indirect market risk – downside protection via the 0% floor |

| Flexibility | Less flexible | More flexible in terms of premium payments and death benefit options |

| Potential Returns | Lower, more predictable returns | Potential for higher returns than whole life, but with caps on upside |

| Best Suited For | Conservative investors seeking stability | Investors comfortable with some market-linked risk, seeking flexibility and potential for higher growth |

Find out how to calculate your net worth.

How Indexing Works

With an IUL, your cash value is linked to a market index like the S&P 500, but you’re not actually investing in the market. It’s like using the market as a yardstick to measure potential gains.

- The Upside: When the index does well, your policy earns interest, up to a certain cap.

- The Downside Protection: If the market tanks, you won’t lose money because of the 0% floor.

Tax Advantages and Borrowing Against Your IUL

- Tax Advantages: The IRS treats life insurance favorably, allowing you to access your cash value in a tax-efficient way.

- Borrowing Against Your IUL: Need cash? You can borrow against your IUL’s cash value.

- Keep in mind that this will reduce your death benefit, but it gives you access to funds when you need them.

Child Head Start Plans

Consider setting up an IUL for your kids. These “child head start plans” can provide a significant financial boost for their future.

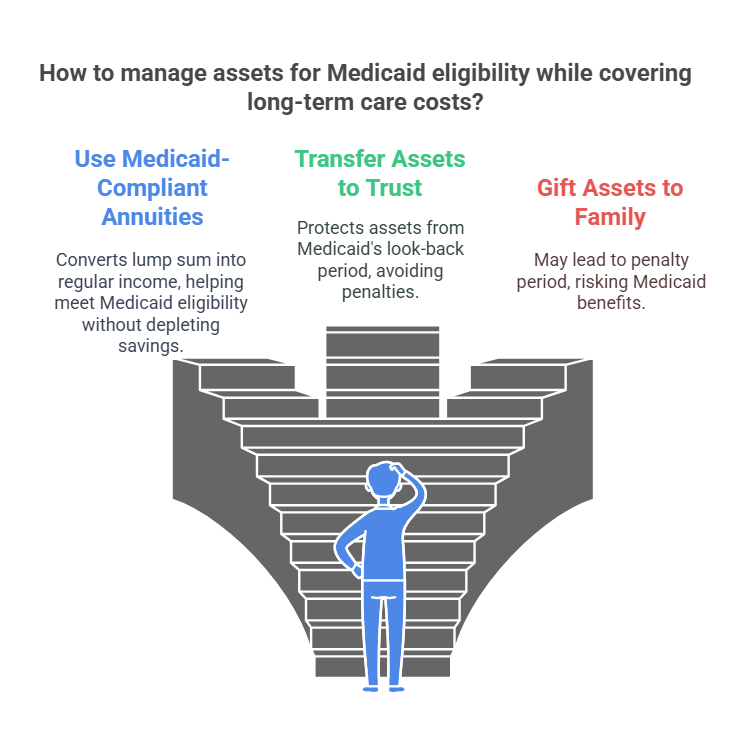

Life Insurance hacks for Business Owners

If you own a business, life insurance can be an invaluable tool.

Buy-Sell Agreements

Life insurance can fund the purchase of a business owner’s interest upon death or during their lifetime. This ensures a smooth transition and protects the business’s future.

Key Person Insurance

- Protect your business from the loss of a key employee.

- The cash value can also fund executive benefit plans to attract and retain top talent.

Retirement Planning for Business Owners

Use the cash value of your life insurance as a supplemental retirement income source. This can provide financial security beyond the success of your business.

Family Provision

Ensure all your children are provided for, whether they’re involved in the business or not. Life insurance death benefits can help create a fair distribution of assets.

Layered Asset Protection

Use a combination of LLCs and hybrid trusts to shield your business and personal assets from potential threats.

Final Thoughts: Taking Control of Your Financial Future

Life insurance is more than just a policy; it’s a versatile tool that can help you achieve your financial goals. Whether you’re planning for long-term care, seeking tax-advantaged growth, or protecting your business, understanding these strategies is the first step toward securing your financial future.

Key Takeaways

- Asset protection and preservation are crucial for financial security.

- Medicaid-compliant annuities can help you qualify for Medicaid while protecting your assets.

- IULs offer tax-advantaged growth potential with downside protection.

- Life insurance provides valuable solutions for business owners.

See what percentage of Americans have a net worth of over $1 million.

By taking a proactive approach and exploring these life insurance hacks, you can unlock financial growth and create a more secure future for yourself and your loved ones.

FAQs

1. How do you take advantage of life insurance?

Life insurance isn’t just about financial protection—it can be a powerful financial tool. You can leverage policies like Indexed Universal Life (IUL) or Whole Life Insurance to accumulate cash value, borrow against it, and use it for retirement or investments. Some policies also provide tax advantages and estate planning benefits.

2. Who has the greatest need for life insurance?

Life insurance is essential for:

- Parents and families who want to provide financial security for their loved ones.

- Business owners who need buy-sell agreements or key person insurance.

- High-net-worth individuals looking for estate planning and tax benefits.

- Anyone with significant debt or dependents who rely on their income.

3. Can I borrow on life insurance?

Yes, if you have a permanent life insurance policy (such as Whole Life or IUL), you can borrow against the accumulated cash value. The loan is tax-free, but it reduces the death benefit if not repaid.

4. What is the best use of whole life insurance?

Whole life insurance is best for:

- Building guaranteed cash value over time

- Providing lifelong coverage

- Using as a tax-free wealth transfer tool

- Borrowing against the policy for financial needs

5. How to turn life insurance into cash?

You can access cash from your life insurance by:

- Taking a loan against the policy’s cash value

- Surrendering the policy for its cash value

- Selling the policy through a life settlement

- Using dividends (for participating whole life policies)

6. How to use life insurance to build wealth?

You can build wealth through:

- Tax-advantaged cash value accumulation

- Borrowing against the policy for investments

- Funding retirement with tax-free withdrawals

- Passing down wealth to heirs tax-efficiently

7. How does money grow in a life insurance policy?

- Whole Life: Grows at a fixed, guaranteed rate.

- IUL: Grows based on stock market index performance (with caps and floors).

- Variable Life: Invests cash value in mutual fund-like subaccounts.

8. How did the Rockefellers use life insurance?

The Rockefellers used life insurance as a wealth-building and estate-planning tool, creating a system where policies funded trusts that supported future generations while avoiding heavy estate taxes. This strategy is often called “Infinite Banking” or “Family Banking.”

9. What are the disadvantages of whole life insurance?

- Higher premiums than term life insurance.

- Lower returns compared to direct market investments.

- Limited flexibility in adjusting premiums and coverage.

- Cash value growth can be slow in the early years.