Is financial freedom on your mind?

You’re not alone! A whopping 53% of us are plotting financial resolutions, seeking that sweet spot of security and independence. But navigating the world of saving, spending, and investing can feel like decoding a secret language. Fear not! This isn’t just another generic finance blog. We’re diving deep into actionable hacks that can transform your financial freedom in 2025 and beyond, drawing insights straight from experts.

The Myth of the “Rich Only” Investment Club

Let’s bust a major myth right off the bat: investing isn’t just for the elite. It’s not some exclusive club reserved for those who’ve already “made it.” In fact, investing is how you get there. Thinking you need a million bucks before even considering investments? That’s precisely the mindset holding many back.

The truth? Investing is for everyone, regardless of income level. The real secret sauce is starting early and playing the long game. Ditch the get-rich-quick fantasies and embrace the power of slow, steady growth. Think of it as watching paint dry – yes, it can be that uneventful, but the end result is a beautiful, solid foundation.

Read also : How Do You Calculate Your Net Worth? Simple Steps to Track, Grow, and Protect Your Wealth

Target Date Funds: Your “Easy Button” for Investing

Overwhelmed by the sheer volume of investment options? Target date funds (TDFs) are your shortcut to simplicity. Imagine an “easy button” for your financial future. Here’s the lowdown:

- Choose a fund that aligns with your expected retirement year (think Vanguard 2065, Fidelity 2065, or Schwab 2065).

- Automatic diversification: The fund spreads your investments across a mix of stocks and bonds, so you don’t have to stress about picking individual winners.

- Hands-free adjustments: As retirement nears, the fund automatically shifts to more conservative, lower-risk investments, safeguarding your gains.

Where to find these magical funds? Look no further than Vanguard, Schwab, or Fidelity. These reputable companies offer a range of TDFs to suit your specific retirement timeline.

Automate and Conquer: Your Secret Weapon

Consistency is the golden rule of investing. So, how do you stick with it when life throws curveballs? Automation, my friend, is your secret weapon.

Set up an automatic monthly transfer from your checking account directly into your investment fund. Treat it like a non-negotiable bill, a habit so ingrained it puts brushing your teeth to shame.

Unleash the Beast: The Magic of Compounding

Real wealth doesn’t materialize overnight with some magic trick; it’s the beautiful outcome of compounding returns over decades.

To truly grasp this concept, let’s crunch some numbers:

| Age You Start | Monthly Investment | Years to Retirement (Age 65) | Estimated Interest Rate (7%) | Projected Value at Retirement |

|---|---|---|---|---|

| 25 | $500 | 40 | 7% | $1,287,778 |

| 35 | $750 | 30 | 7% | $757,037 |

| 45 | $1200 | 20 | 7% | $594,347 |

As this table clearly illustrates, the earlier you start, the less you need to invest each month to reach your desired retirement nest egg. The magic of compounding works wonders when given ample time.

Financial Housekeeping: Structure for Success

Think of your finances like a well-organized home: everything has its place and runs smoothly. Prioritize setting up an automated account structure. This means:

- Automated transfers to your savings and investment accounts.

- Automatic bill payments, especially that pesky credit card debt.

Defeat Ignorance: Knowledge is Your Shield

One of the most costly things in life is the knowledge you don’t have. In the financial realm, ignorance can lead to missed opportunities and costly mistakes. Arm yourself with knowledge! Read books, follow reputable financial blogs, and don’t hesitate to consult with a qualified financial advisor.

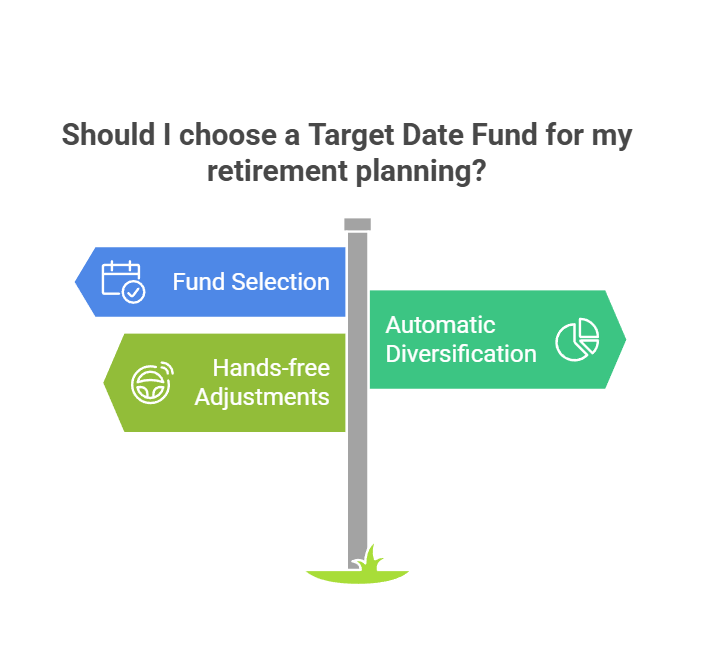

Unlock Leverage: Multiply Your Efforts

Leverage is the secret sauce that separates those who simply “get by” from those who truly thrive. It’s about maximizing your output with minimal input. Consider these different forms of leverage:

- Labor: Getting more done with other people’s efforts.

- Media: Creating content once and distributing it infinitely.

- Capital: Using money to make more money.

- Technology: Building systems that scale without requiring constant human intervention.

Strive to identify opportunities with high leverage to amplify your earning potential.

Skills + Money: Discover Your Niche

To truly maximize your income, consider these two crucial factors: the size of the problem you’re tackling and the value of the solution you provide. Align your unique skills with sectors that boast high profitability and explosive growth potential.

The Tax Game: Play Smart, Not Hard

Let’s face it: tax avoidance is a key skill for building wealth. The wealthy often employ savvy tax strategies to minimize their tax burden, freeing up more capital for investments and growth. While we’re not advocating for illegal tax evasion, understanding legal avenues for minimizing your tax liability is crucial.

From Earner to Owner: Shift Your Mindset

The key to long-term wealth isn’t just earning a high income; it’s owning assets that generate passive income. Think real estate, stocks, or even your own business. Strive to transition from being a high-earning employee to a savvy asset owner.

Read also : Redefining Wealth in America: What net worth is considered rich in USA?

Investing Strategies: Keep It Simple, Stay the Course

Keep your investment approach streamlined and manageable. A well-rounded strategy might include:

- Cash: For emergencies and short-term needs.

- A Home: Primarily as a lifestyle choice, not a guaranteed investment.

- Index Funds: Diversified, low-cost investments that mirror the performance of the overall market.

Dollar-cost averaging (investing a fixed amount regularly) and unwavering endurance are your most powerful tools.

Homeownership: Lifestyle Choice, Not a Golden Ticket

While owning a home is a significant milestone, it’s crucial to view it as a lifestyle choice, not a surefire investment.

Historically, when adjusted for inflation, housing prices have remained relatively flat.

Blockchain and Crypto: Dive into the Future (Responsibly)

Blockchain technology is revolutionizing how we exchange value and verify truth in the digital world. Cryptocurrencies offer a globally accessible investment avenue, potentially disrupting traditional financial systems.

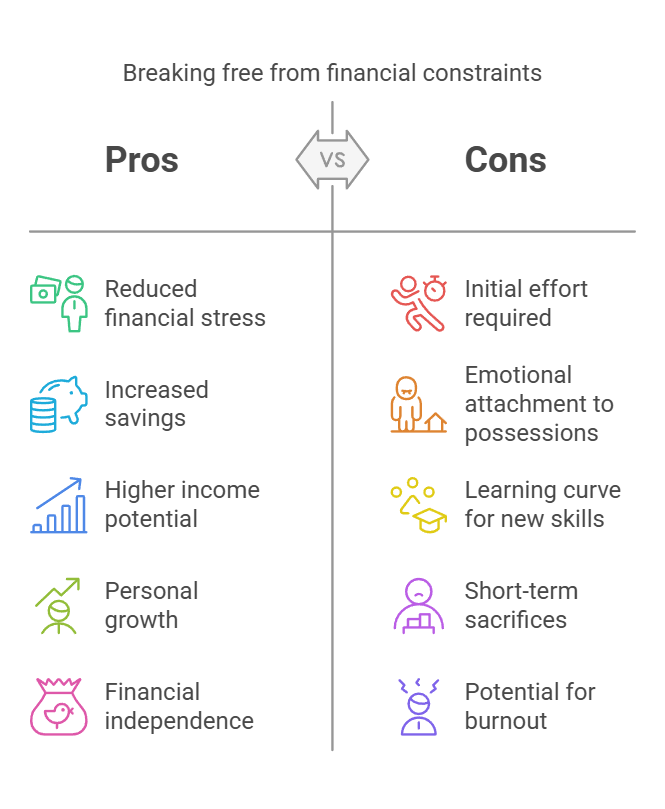

Breaking Free: The Paycheck-to-Paycheck Escape Plan

Tired of living on the financial edge? It’s time to break the chains of the paycheck-to-paycheck cycle. The key is to prioritize enriching yourself before enriching everyone else. This means:

- Aggressively cutting unnecessary expenses.

- Selling unused possessions for quick cash.

- Investing time in learning new skills and boosting your income.

Mindset Matters: The Foundation of Wealth

Ultimately, your financial success hinges on your mindset and unwavering discipline. Cultivate a long-term vision, resist impulsive spending, and prioritize building wealth over fleeting appearances. As the video emphasizes, the very first step to wealth lies in your own mindset and iron-clad discipline.

Financial freedom is a marathon, not a sprint. By adopting these hacks, automating your finances, and cultivating a wealth-building mindset, you’ll be well on your way to securing your financial future.

FAQs

1. What is a good credit score?

A good credit score typically ranges between 670 and 739. Maintaining a good credit score is essential for securing favorable loan terms and interest rates. Regularly monitoring your credit and managing debts responsibly can help maintain or improve your score.

2. How much money do you need to open a savings account?

The initial deposit required to open a savings account varies by financial institution. Some banks allow you to open an account with as little as $1, while others may require a higher minimum balance. It’s advisable to check with your chosen bank for specific requirements.

3. What is a budget, and what are the benefits of budgeting?

A budget is a financial plan that outlines your expected income and expenses over a specific period. Budgeting helps you manage your money effectively, ensuring you can cover essential expenses, save for future goals, and avoid unnecessary debt.

4. How do personal loans work?

Personal loans are unsecured loans provided by financial institutions that you can use for various purposes, such as consolidating debt, making a large purchase, or covering unexpected expenses. They typically have fixed interest rates and repayment terms. Approval and terms depend on your creditworthiness and financial history.

5. How can I improve my credit score?

Improving your credit score involves several steps:

- Pay bills on time: Consistently paying your bills by their due dates positively impacts your credit score.

- Reduce debt: Lowering your overall debt decreases your credit utilization ratio, which can boost your score.

- Avoid opening unnecessary new credit accounts: Each new credit inquiry can slightly lower your score; only apply for new credit when necessary.

- Regularly check your credit report: Monitoring your credit report helps you identify and dispute any errors that may be affecting your score.

6. What is overdraft protection?

Overdraft protection is a service offered by banks that prevents transactions from being declined when you don’t have sufficient funds in your account. Instead, the bank covers the shortfall, and you repay the amount, often with an additional fee. While it can prevent the inconvenience of declined transactions, it’s important to use it cautiously to avoid accumulating fees.

7. How do reverse mortgages work?

A reverse mortgage is a loan available to homeowners aged 62 or older, allowing them to convert part of their home equity into cash. Unlike a traditional mortgage, the borrower doesn’t make monthly payments. Instead, the loan is repaid when the homeowner sells the house, moves out permanently, or passes away. It’s essential to understand the terms and implications fully, as reverse mortgages can affect inheritance and the homeowner’s equity.

8. How much income do you need to file taxes?

The minimum income required to file taxes varies based on factors like filing status, age, and the type of income received. For example, in the 2024 tax year, a single filer under 65 was required to file taxes if their gross income was at least $12,550. Tax thresholds can change annually, so it’s important to consult the latest IRS guidelines or a tax professional to determine your filing requirements.