Introduction

Imagine this: payday rolls around, but by the time bills are paid and a few splurges are indulged, your bank account is gasping for air. The stress of not knowing where your money is going or feeling overwhelmed by financial decisions is all too common. Fortunately, there’s a way to fix that—enter the Financial Order of Operations (FOO), your roadmap to financial freedom.

The FOO is a step-by-step strategy designed to help you prioritize financial goals. It creates a solid foundation for managing money effectively while leaving room to enjoy life along the way. Think of it as a guide for making informed, stress-free financial decisions that promote long-term growth. In this blog post, we’ll break down the FOO and show you how to implement it to achieve your financial goals.

What Is the Financial Order of Operations (FOO)?

The Financial Order of Operations is a system for managing your money—a blueprint that ensures you prioritize the right actions in the right sequence. Much like PEMDAS in mathematics, the FOO helps solve financial problems methodically and avoids unnecessary chaos.

Whether you’re tackling debt, saving for a big purchase, or investing for retirement, the FOO provides a framework for staying on track and continuously improving your financial strategy. It’s adaptable to any stage of life, whether you’re just starting your financial journey or already building wealth.

Key takeaway: The FOO works universally and offers a clear, step-by-step approach to managing finances effectively.

Read also: Is a $500K net worth good?

The Ground Rules of the FOO

Before diving into the steps, let’s establish the guiding principles that make the FOO so effective:

- Generosity is a Priority (Step 0): Giving back—whether through time, money, or resources—is fundamental to building a fulfilling life.

- Aim to Save 25% of Gross Income: While this might take time to achieve, it’s a critical long-term goal.

- Debt Is a Four-Letter Word: Use debt wisely and avoid letting it control your financial decisions.

- Enjoy Your Work: Passion for what you do makes financial goals more achievable.

- Live Life to the Fullest: Balancing financial discipline with enjoying life’s moments is key.

These principles remind us that the FOO isn’t just about numbers; it’s about creating a balanced, meaningful financial life.

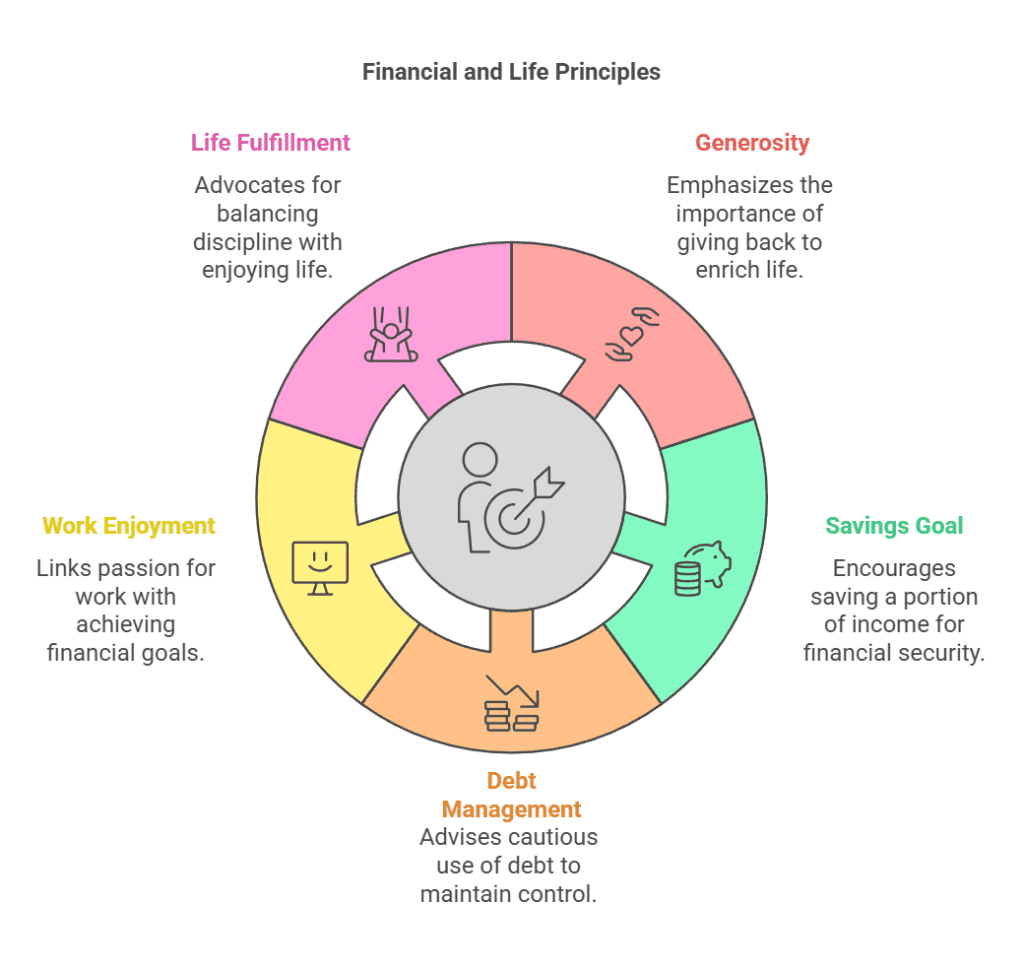

The Steps of the Financial Order of Operations

While different versions of the FOO exist, this guide focuses on a widely accepted 10-step version. Don’t feel pressured to tackle everything at once; the FOO is designed for progress, not perfection.

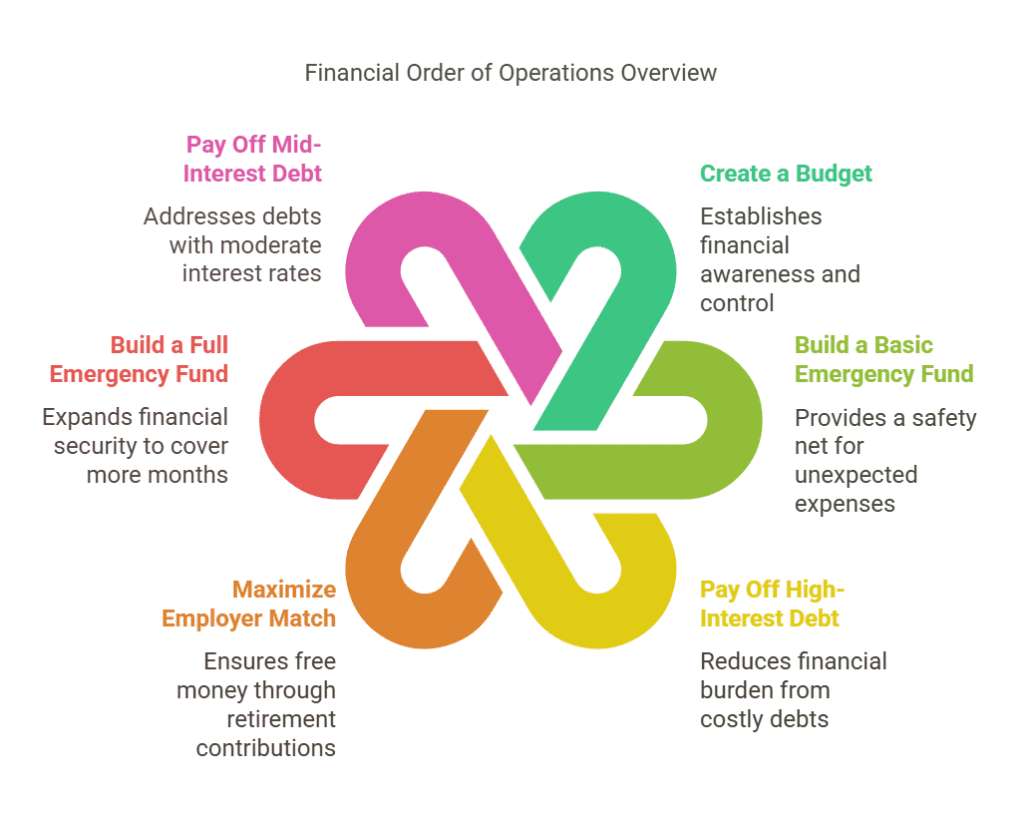

Step 1: Create a Budget

A budget is your financial baseline. It helps you understand where your money is coming from and where it’s going. Contrary to popular belief, budgets aren’t restrictive—they’re empowering tools for intentional spending.

Pro Tip: Use budgeting apps like Mint or YNAB to streamline the process.

Step 2: Build a Basic Emergency Fund

An emergency fund acts as your financial safety net, covering unexpected expenses like car repairs or medical bills. Start with at least one month of living expenses or enough to cover insurance deductibles.

Key takeaway: This step prevents reliance on high-interest credit cards during emergencies.

Step 3: Pay Off High-Interest Debt

High-interest debt (typically above 8-10%) is a major drain on your finances. Focus on paying off credit cards and personal loans using the debt avalanche method (tackling high-interest debts first) or the debt snowball method (paying off small balances first for psychological wins).

Step 4: Maximize Employer Match

If your employer offers a match on retirement contributions like a 401(k), take full advantage. This is essentially free money with a guaranteed return.

Example: If your employer matches up to 5% of your salary, contribute at least that amount to secure the match.

Step 5: Build a Full Emergency Fund

Once you’ve tackled high-interest debt and secured your employer match, focus on expanding your emergency fund to cover 3-6 months of living expenses. Business owners should aim for 6-12 months.

Tip: Keep this fund in a high-yield savings account like Ally Bank or Marcus by Goldman Sachs.

Step 6: Pay Off Mid-Interest Debt

Mid-interest debt (6-8%) includes loans like student debt. Paying these off guarantees a return that’s comparable to average market gains.

Step 7: Maximize Tax-Advantaged Accounts

Invest in accounts that offer tax benefits, such as Roth IRAs and HSAs.

- Roth IRAs: Ideal for younger investors, these accounts allow tax-free growth.

- HSAs: Use these for medical expenses or as a stealth retirement account due to their triple tax advantages.

Step 8: Maximize Employer Retirement Plans

After securing the match, focus on maxing out contributions to employer plans like 401(k)s or 403(b)s. These contributions lower your taxable income while building retirement savings.

Step 9: Pay Off Low-Interest Debt

Low-interest debt (below 6%), such as mortgages, is less urgent. Some choose to invest instead since market returns often exceed the interest rate. However, paying off this debt can offer peace of mind.

Step 10: Prepay Future Expenses

Save for significant future expenses like a home, car, or your child’s education. Consider 529 plans for college savings to benefit from tax advantages.

A Quick Comparison: FOO vs. Other Financial Strategies

| Aspect | FOO | Dave Ramsey’s Baby Steps |

|---|---|---|

| Debt Prioritization | Focuses on interest rates | Focuses on smallest debts first |

| Investment Emphasis | Early and consistent investing | Investing starts after debt payoff |

| Flexibility | Highly adaptable | More rigid sequence |

| Emergency Fund Target | Starts small, grows over time | Immediate full emergency fund |

Key takeaway: The FOO emphasizes investing early while maintaining flexibility, making it a more modern approach.

Additional Considerations

- The 25% Savings Rule: Aim to save and invest 25% of your gross income for retirement.

- Hyperaccumulation: Diversify savings across taxable, tax-deferred, and Roth accounts for maximum growth.

- Sinking Funds: Use these to save for short-term goals like vacations or home improvements.

- Automate Savings: Set up automatic transfers to ensure consistency.

Read also: Doug Kurtenbach Net Worth

Adapting the FOO to Your Needs

Remember, the FOO is a guideline, not a one-size-fits-all solution. Tailor it to your financial situation and goals. If you’ve already made progress in certain areas, you can fast-track through some steps.

Pro Tip: Revisit earlier steps periodically to ensure you’re on track.

Conclusion

The Financial Order of Operations is a powerful tool for achieving financial freedom. By following its step-by-step approach, you’ll reduce financial stress, build wealth, and enjoy life’s moments along the way.

Start small, stay consistent, and remember that every step forward is progress. Ready to take control of your finances? Share this guide with others or subscribe to our newsletter for more financial tips and strategies!

FAQs

1. What is the Financial Order of Operations (FOO)?

The FOO is a step-by-step framework to prioritize financial decisions, like paying off debt, saving, and investing, in the most efficient order. It’s designed to help you build wealth while avoiding costly mistakes.

2. How is the FOO different from Dave Ramsey’s Baby Steps?

The FOO emphasizes capturing employer retirement matches before paying off all debt, while Ramsey prioritizes debt elimination first. The FOO also encourages investing earlier to leverage compound growth.

3. Can the FOO work for low-income earners?

Yes! The FOO is flexible. Start with what you can—even a $500 emergency fund or 1% retirement contributions—and scale up as your income grows.

4. Why split the emergency fund into “starter” and “full” steps?

A starter fund ($1k–1 month of expenses) prevents debt relapse during small emergencies. The full fund (3–6 months) comes later to protect against bigger crises like job loss. High-yield savings accounts keep this cash accessible.

5. Should I prioritize debt or investing first?

Depends on the debt’s interest rate:

- Above 8%: Pay it off ASAP (e.g., credit cards).

- Below 6%: Invest first (historically, markets return ~10% annually).

6. What if I don’t have an employer retirement match?

Skip Step 4 and focus on maxing tax-advantaged accounts like a Roth IRA or HSA. Self-employed? Use a SEP-IRA or Solo 401(k).

7. Is the 25% savings goal realistic?

It’s aspirational but achievable over time. Include employer matches, HSAs, and retirement contributions. Start with 10% and increase by 1-2% yearly.

8. Should I pay off my mortgage early?

Only if the psychological win outweighs potential market gains. A 3% mortgage is cheaper than average market returns, so investing often makes more sense.

9. How do I handle student loans with the FOO?

High-interest private loans (>8%) go in Step 3. Federal loans (<6%) wait until Step 9. Use income-driven repayment plans if needed.

10. Can I skip steps if I’m already financially stable?

Yes! The FOO is customizable. If you’ve already maxed retirement accounts, jump to hyperaccumulation or legacy planning.