Thinking about getting a new set of wheels but still making payments on your current vehicle? You’re not alone. A common question among car owners is: can i trade in a financed car? The short answer is yes, you absolutely can trade in a car that isn’t fully paid off. However, it’s crucial to understand that the existing loan doesn’t simply vanish. This comprehensive guide will walk you through every step of the process, explain key concepts like equity and loan payoff, and provide essential tips to navigate your trade-in smoothly. Learn how trading in a financed vehicle works and make informed decisions to get the best outcome.

Understanding the Basics: Trading In a Car With a Loan

So, can i trade in a financed car without any complications? While possible, there are important factors to consider. When you trade in a car you own outright, its value is directly applied towards your new purchase. However, when a loan is involved, the dealership has to consider your outstanding balance. Trading in a financed car essentially involves a few extra steps to resolve your current loan.

Determining Your Loan Balance and Vehicle Value

The first step in understanding if and how you can trade in your financed car is to determine the exact balance remaining on your current auto loan. This information can usually be found on your monthly payment statement or by contacting your lender directly. Keep in mind that the payoff amount might include accrued interest and could be slightly higher than the principal balance.

Next, you’ll need to estimate the current trade-in value of your vehicle. Several online valuation tools can help with this, such as:

- Dealership tools: Value Your Trade (Chevrolet Center Inc)

- Luxury brand tools: Mercedes-Benz Trade-In Tool

- Independent sources:

These tools typically consider factors like your car’s make, model, year, mileage, and condition.

Important note: Online valuations are estimates. The final trade-in offer will be based on the dealership’s inspection. For example, CarMax offers no-haggle appraisals that are valid for 7 days. Always get an in-person appraisal from the dealership you plan to trade with—this is a crucial step in the process.

Read Also : What is the $1000 a month rule for retirement

Positive vs. Negative Equity: Knowing Your Position

Once you know your loan balance and your car’s estimated trade-in value, you can determine your equity situation.

Table 1: Equity Scenarios When Trading In a Financed Car

| Scenario | Description | Example | Outcome |

|---|---|---|---|

| Positive Equity | Car is worth more than what you owe | Owe $7,000, car worth $8,000 | $1,000 applied as down payment |

| Negative Equity | You owe more than the car is worth | Owe $7,000, car worth $6,000 | $1,000 added to new loan or paid out |

How the Trade-In Process Works With a Financed Vehicle

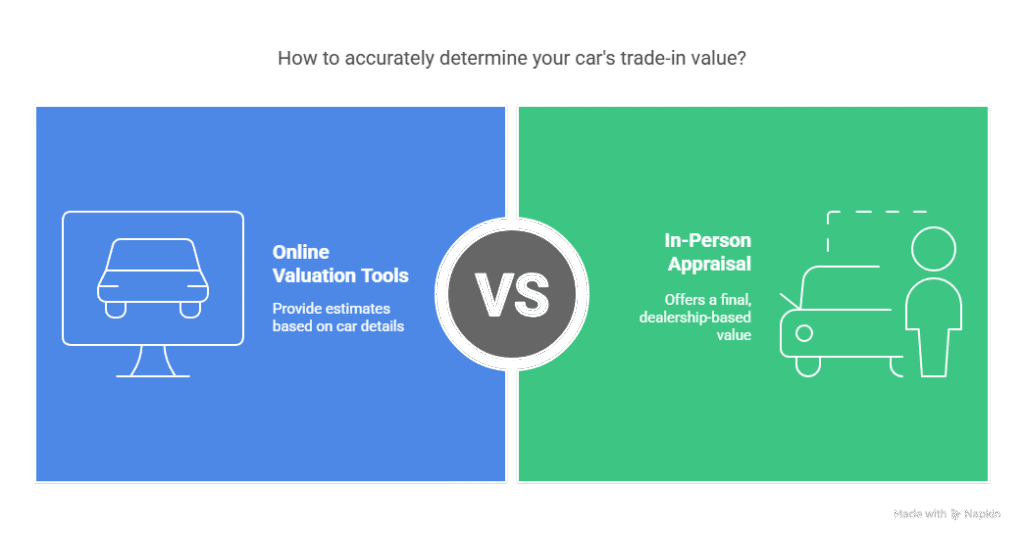

Now that you understand your equity position, let’s delve into how the trade-in process typically unfolds when you still have a car loan:

- Inform the Dealership: Be upfront with the dealership about the fact that your current vehicle is financed. Honesty will help them guide you through the necessary steps.

- Provide Lender Information: The dealership will likely need information about your lender, such as the loan account number. In many cases, the dealership will contact your lender directly to obtain the title after the sale is finalized.

- Undergo Appraisal: The dealership will inspect your vehicle to determine its trade-in value. Remember that this appraisal might differ from online estimates. CarMax emphasizes that their appraisal is a separate, firm offer.

- Negotiate Separately: It’s a best practice to negotiate the trade-in value of your current car and the price of the new vehicle separately. This helps you ensure you’re getting a fair offer for your trade-in and a good price on your new car without confusing the two.

- Review the Purchase Agreement: Carefully review the purchase agreement for your new car. Ensure that the agreed-upon trade-in value is accurately reflected and that the details of your existing loan payoff are clearly outlined.

- Finalize Paperwork: Complete all the necessary paperwork for the trade-in and the purchase of your new vehicle.

Dealing With Your Existing Car Loan During a Trade-In

The crucial aspect of trading in a financed car is how your existing loan is handled:

- Loan Payoff by the Dealership: In most cases, the dealership will take on the responsibility of paying off your existing loan using the trade-in value of your car.

- Positive Equity Scenario: If you have positive equity, the excess amount after paying off your old loan can be used as a down payment on your new car.

- Negative Equity Scenario: If you have negative equity, the trade-in value won’t fully cover your existing loan. You will need to address this remaining balance.

Options for Handling Negative Equity

When you find yourself in a negative equity situation, you have a few options:

Table 2: Handling Negative Equity Options

| Option | Description | Pros | Cons |

|---|---|---|---|

| Pay Difference Out-of-Pocket | Pay the gap between loan balance and trade-in value | Immediate payoff | Requires upfront cash |

| Roll Over Negative Equity | Add remaining loan balance to your new car loan | No upfront payment | Larger loan, more interest, upside-down |

| Trade for Cheaper Vehicle | Choose a less expensive car to reduce debt burden | Lower payments | Still must cover negative equity |

Trading In a Financed Car for a Lease

Yes! Trading in a financed car for a lease is absolutely possible, and the process works similarly to a traditional trade-in. Here’s what you need to know:

How It Works

- Dealership Assessment

- The dealer will appraise your current vehicle’s trade-in value (use KBB Instant Cash Offer for a baseline estimate).

- They’ll pay off your existing auto loan (get your 10-day payoff amount first).

- Equity Scenarios

- Positive Equity? This can be used as a capital cost reduction (like a down payment) to lower lease payments.

- Negative Equity? The remaining balance typically gets rolled into your new lease, increasing monthly payments.

Key Considerations

✔ Faster Upgrades – Leasing lets you swap cars every 2-3 years (great if you love new tech/features).

⚠ Higher Costs – Rolling over negative equity into a lease can be expensive (see Edmunds’ lease calculator to estimate payments).

🔍 Compare Offers – Check lease deals at multiple dealerships to maximize equity value.

Pro Tip: Some brands (like Mercedes-Benz or BMW) offer lease loyalty incentives that may offset negative equity.

Read Also : Level Up Your Finances: Proven Hacks for Financial Freedom in 2025

Important Considerations Before Trading In Your Financed Car

Before you decide to trade in your financed car, consider these important factors:

- Current Market Conditions: The value of used cars can fluctuate based on market supply and demand. According to the YouTube video by Ideal Cars, trade-in values were significantly lower recently due to increased new car inventory. This is a crucial factor to be aware of, as you might receive a lower offer than expected. The video suggests that dealerships are “drowning in inventory” and offering “absolute garbage” for trade-ins, potentially 25-30% worse than two years prior. This might make selling privately a more financially sound option.

- Impact on Your Credit Score: Obtaining a new car loan can affect your credit score. Rolling over a large amount of negative equity might also negatively impact your creditworthiness. It’s advisable to speak with a non-profit credit counselor if you have concerns about the impact on your credit.

- Interest Rates: Be aware of current interest rates for new and used car loans. If interest rates are high, rolling over negative equity can become even more expensive over time.

- Potential Lender Fees: Check your existing loan agreement for any potential early termination fees or other charges associated with paying off the loan early. Factor these into your decision.

- Budgeting for Increased Payments: If you roll over negative equity or finance a more expensive vehicle, ensure that you can comfortably afford the increased monthly payments.

- State-Specific Tax Implications: Some states offer trade-in sales tax credits, where you are only taxed on the difference between the new car’s price and your trade-in value. Understand the tax laws in your state, as this can impact the overall cost.

Alternatives to Trading In at a Dealership

While trading in at a dealership is convenient, consider these alternatives:

- Selling Your Car Privately: You might be able to get a higher selling price by selling your car directly to a private buyer. However, this requires more effort, including listing the car, negotiating with potential buyers, and handling the paperwork. The Ideal Cars video strongly recommends selling privately if you need to get rid of your car, as dealerships are offering low trade-in values.

- Exploring Online Car Buying Platforms: Several online platforms allow you to sell your car with a potentially streamlined process.

- Keeping Your Car Longer: Given the current market conditions, as highlighted in the Ideal Cars video, keeping your car longer might be the most financially prudent option. Paying down your loan and building positive equity will put you in a stronger position when you eventually decide to upgrade. The video notes that more people are extending their car ownership to 10 years or longer.

- Refinancing Your Existing Car Loan: If high interest rates are a concern, exploring refinancing options for your current loan might lower your monthly payments and improve your financial situation.

Expert Tips for a Successful Financed Car Trade-In

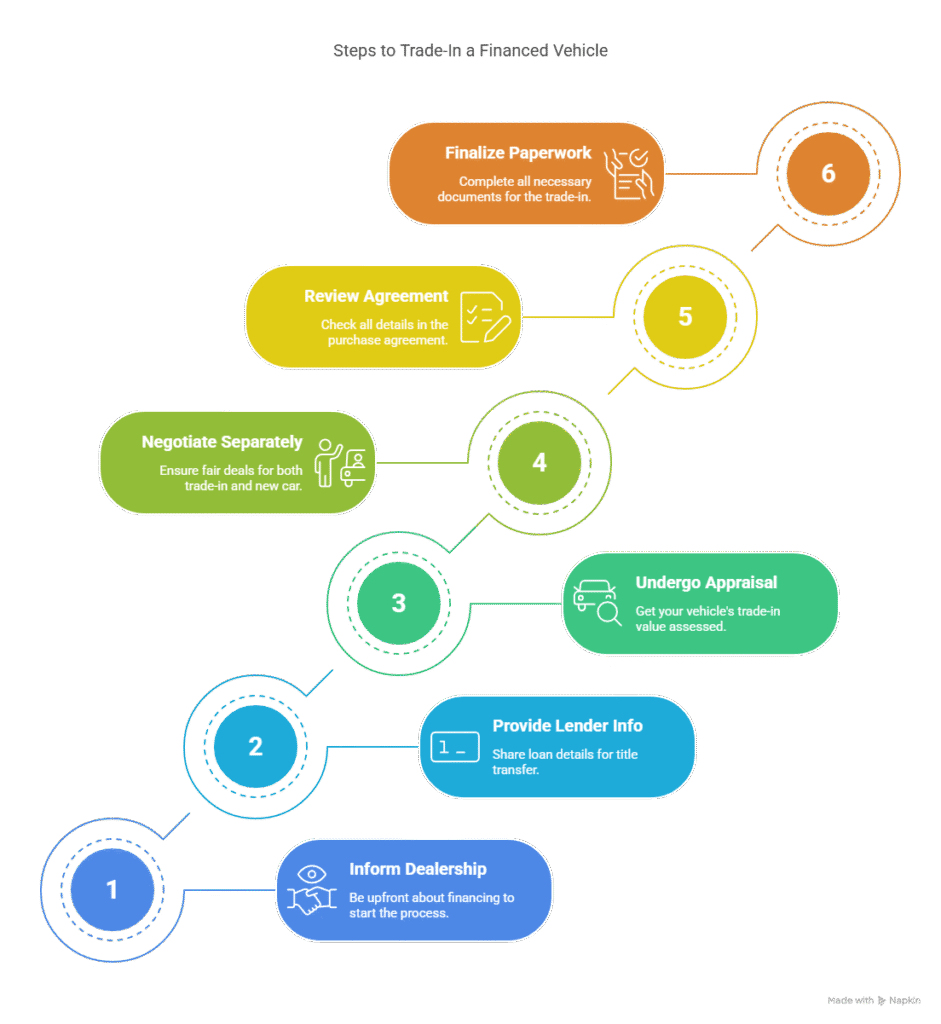

To make your trade-in experience as smooth as possible, follow these expert tips:

- Prepare Your Car for Appraisal: Clean your car inside and out and gather any maintenance records. Be upfront about any cosmetic or mechanical issues.

- Get Multiple Appraisals: Obtain trade-in quotes from several dealerships (and potentially online buyers) to ensure you’re getting a competitive offer.

- Understand Your Car’s Market Value: Research the value of similar vehicles in your area using online resources.

- Negotiate Separately: Keep the negotiation for your trade-in value and the new car price distinct.

- Bring All Necessary Documents: Have your car’s title, registration, loan information, proof of insurance, and driver’s license readily available.

- Notify Your Lender: Inform your lender of your intention to trade in the vehicle.

- Review the Contract Thoroughly: Carefully read and understand all the terms of the purchase agreement before signing. Double-check all the numbers.

- Confirm Loan Payoff: A few weeks after the deal, verify that your old car loan has been completely paid off by your lender.

Conclusion: Making an Informed Decision About Your Financed Car Trade-In

Trading in a car with an existing loan is a common practice and definitely possible, as explained in this Consumer Reports guide to trading in financed cars. However, it requires careful planning, a clear understanding of your financial situation using tools like NerdWallet’s auto loan calculator, and awareness of the current market dynamics from sources like Cox Automotive’s market insights.

By determining your loan balance through your lender’s portal and vehicle value using Kelley Blue Book’s trade-in tool, understanding the implications of positive or negative equity with help from Edmunds’ equity explainer, and carefully navigating the trade-in process outlined by the Federal Trade Commission, you can make an informed decision that aligns with your financial goals.

Read Also : Is a $500K net worth good? Let’s Break It Down

FAQs

1. I Owe $20,000 on My Car—Can I Trade It In?

Yes, but it depends on your car’s trade-in value.

- If your car is worth more than $20,000, you’ll have positive equity (the difference can go toward your next car).

- If it’s worth less than $20,000, you’re upside-down (you’ll owe the difference or roll it into a new loan).

Tip: Check your car’s value on KBB or Edmunds.

2. Can I Trade In a Financed Car for a Cheaper Car?

Yes, and it’s a smart move if you want to lower payments.

- If you have negative equity, the remaining balance gets added to the new loan (raising monthly costs).

- If you have positive equity, it reduces the amount you need to finance.

Best option: Sell privately or pay down the loan first to avoid rolling over debt.

3. How Soon Can You Trade In a Financed Car?

Immediately, but early trade-ins often mean negative equity because cars depreciate fastest in the first year.

- Wait at least 2–3 years to build equity unless you have a major financial reason (e.g., high repair costs).

- Check for early payoff penalties in your loan terms.

4. Does Trading In a Financed Car Hurt Your Credit?

Minimally. Key impacts:

- A hard inquiry when applying for new financing (drops score 5–10 points temporarily).

- Closing an old loan and opening a new one may slightly affect credit history length.

- No impact if the loan is paid on time and in full.

5. Can I Trade In My Financed Car After 1 Year?

Yes, but you’ll likely owe more than the car is worth.

- New cars lose ~20% of value in the first year.

- If you must trade in early, compare offers (dealers vs. CarMax/Carvana) to minimize losses.

6. Can You Trade In a Financed Car for a Lease?

Yes, but leasing with negative equity is risky:

- Most lease agreements don’t allow rolled-over debt.

- You may need to pay the difference upfront or get a loan to cover it.

Alternative: Wait until your loan balance aligns with the car’s value.

7. I Owe $20K on My Car—Reddit Users’ Experiences

Reddit threads (like r/askcarsales) reveal:

- Dealers won’t forgive debt—you either pay the difference or roll it over.

- Some users regret trading in early due to high depreciation.

- Others negotiated higher trade-in values by shopping around.

8. Are There Dealerships That Pay Off Your Trade No Matter What You Owe?

No legitimate dealer will “eat” your negative equity. They may:

- Roll the debt into a new loan (increasing your payments).

- Inflate the new car’s price to hide the deficit (a bad deal).

Watch out for scams: If an offer sounds too good to be true, it is.

Key Takeaways

✅ You can trade in a financed car anytime, but early trade-ins often mean negative equity.

✅ Trading for a cheaper car can reduce payments but may extend loan terms.

✅ Check your car’s value first—use KBB, Edmunds, or get multiple dealer appraisals.

🚨 Avoid rolling over debt unless absolutely necessary—it increases long-term costs.