Let’s start with a question: What does financial success look like to you? For some, it’s owning a home. For others, it’s retiring early or traveling the world. But when we talk numbers, one figure sparks debate: Is a $500K net worth good?

The answer isn’t a simple yes or no. It’s a dynamic mix of age, location, goals, and even generational perspectives. In this deep dive, we’ll unpack what $500K truly means, how it compares nationally, and whether it’s enough to build the life you want. Spoiler: Context is king. Let’s get into it.

The National Benchmark: How $500K Measures Up

First, let’s ground ourselves in data. According to the Federal Reserve’s 2022 Survey of Consumer Finances, the median U.S. household net worth is $192,900. This means that half of American households have less than this amount, and half have more. A net worth of $500K would place you well above the median, putting you in a more financially secure position compared to most households. That’s 2.6 times the median, placing you in the top 40% of households nationwide.

Wealth isn’t distributed evenly. To break into the top 25%, you’d need around $659,000. For the top 10%, that number jumps to $1.9 million. So, while $500K may not be considered “rich” by elite standards, it’s still a substantial cushion—especially if you’re under 50.

Regional Reality Check:

Where you live dramatically impacts how far $500K stretches. For example:

- In San Francisco, where the median home price is 1.3 million, 1.3 million, and 500K might feel modest.

- In Cleveland, Ohio, where the median home is $125,000, that same net worth could fund a comfortable lifestyle with room for investments.

This disparity explains why a 2023 Bankrate study found that 51% of Americans feel “behind” financially—even those with six-figure net worths. Perception is shaped by local norms, not just national averages.

Read also: Decoding Liz Cheney Net Worth

Age Matters: Is a $500K net worth good for your life stage?

Net worth naturally grows with age as careers advance, debts shrink, and investments compound. Let’s break down how $500K stacks up by generation:

| Age Group | Median Net Worth | $500K Comparison | Key Challenges |

|---|---|---|---|

| <35 | $39,000 | 12.8x higher | Student debt, entry-level salaries |

| 35–44 | $135,600 | 3.7x higher | Mortgages, childcare costs |

| 45–54 | $247,200 | 2x higher | Saving for college + retirement |

| 55–64 | $364,500 | 37% higher | Healthcare prep, downsizing |

| 65+ | $409,900 | 22% higher | Fixed income management |

Under 35: If you’ve hit 500K before 35, you’re a statistical unicorn. Most peers are juggling student loans (average 500K before 35; you’re a statistical unicorn). Most peers are juggling student loans (average $37,338 per borrower) and building careers. This net worth suggests aggressive saving, high income, or generational wealth.

35–54: For mid-career professionals, 500K reflects discipline. Consider: The average 401(k) balance for 45-year-olds is just 500K, which reflects discipline. Consider: The average 401(k) balance for 45-year-olds is just 161,079 (Vanguard, 2023). Add home equity and other assets, and $500K becomes achievable—but still above average.

55+: Near retirement, 500K is trickier. While above median, longevity risk looms. A 65-year-old today has a 30,500Kistrickier. While above median, longevity risk looms. A 65-year-old today has a $30,500K over 25+ years, which requires careful planning, especially with rising healthcare costs (average $315,000 per retired couple).

The “Millionaire Next Door” Test: Are You on Track?

In their iconic book The Millionaire Next Door, Thomas J. Stanley and William D. Danko propose a formula to gauge financial health:

Target Net Worth = (Age × Annual Pre-Tax Income) ÷ 10

Let’s test this with real-world examples:

- **Emma, 30, earns $80,000.** Target = (80,000 × 30) / 10 = $240,000.

- $500K Verdict: She’s 108% ahead—a stellar position.

- **Carlos, 55, earns $150,000∗∗: Target = (150,000∗∗: Target = (150,000 × 55) / 10 = $825,000.

- $500K Verdict: He’s 39% behind, signaling a need to ramp up savings.

Criticisms of the Formula:

- Doesn’t account for inheritances or geographic cost differences.

- Prioritizes income over investment returns.

Still, it’s a useful benchmark. By this measure, $500K is strong for mid-career earners but may lag for high-income professionals nearing retirement.

What Does $500K Actually Buy You?

Let’s translate this number into real-life scenarios:

1. Financial Security

- Emergency Fund: A fully funded 6–12 month safety net ($30K–$30K–$60K).

- Debt Freedom: Pay off the average U.S. mortgage ($240,000) and still have $260K left.

- Cash Flow Cushion: Eliminating debt payments frees up ~$1,500/month for investments or experiences.

2. Retirement Readiness

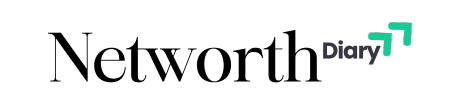

Using the 4% rule, 500K generates 500K, generating 20,000/year. Combined with the average Social Security benefit ($1,907/month), that’s $42,884 annually—enough for a frugal retiree in a low-cost area.

But wait: The 4% rule assumes a 30-year retirement. For longer lifespans, some advisors recommend a 3% withdrawal rate ($15,000/year). This is where supplemental income (rental properties, part-time work) becomes critical.

3. Investment Growth Potential

Invested in a diversified portfolio (e.g., 60% stocks, 40% bonds), $500K could grow to:

- $1.07 million in 10 years (7% annual return).

- $2.01 million in 20 years.

Generational Perspectives: Why $500K Feels Different Today

Younger generations face unique hurdles:

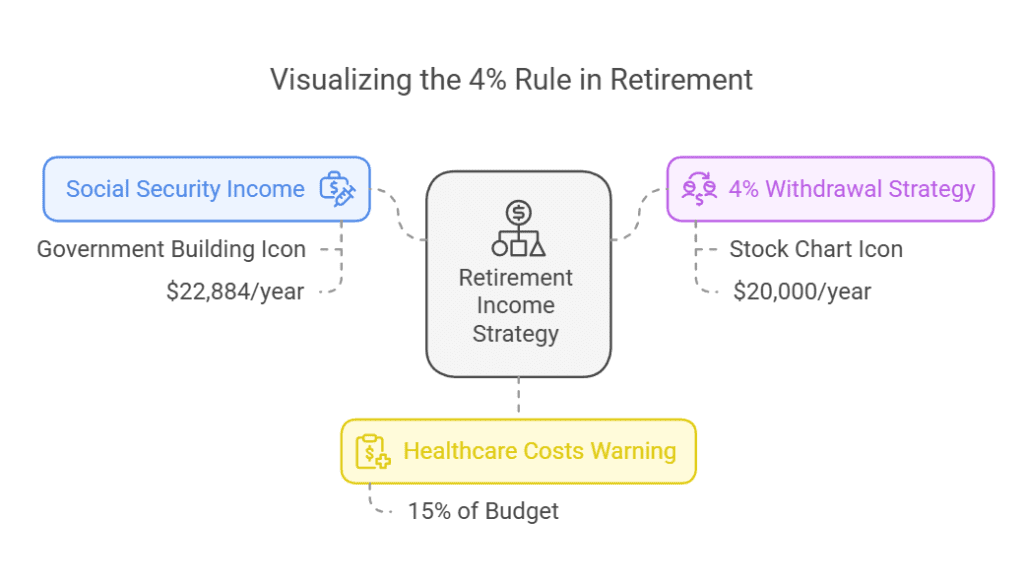

- Gen Z (18–27): Grew up during the 2008 crisis and COVID-19. Many equate wealth with flexibility (e.g., remote work) rather than raw numbers. A Credit Karma survey found 48% believe they’ll never own a home.

- Millennials (28–43): Burdened by student debt and “peak” home prices. A $500K net worth often requires dual incomes and side hustles.

- Gen X (44–59): Squeezed by aging parents and college-bound kids. Only 44% feel confident about retirement (Transamerica, 2023).

- Boomers (60–78): Many rely on pensions and Social Security. For them, $500K is a supplement, not a primary fund.

The Social Media Effect: Platforms like Instagram glorify luxury lifestyles, skewing perceptions. A Stanford study found that frequent social media users overestimate peers’ wealth by 35%.

Case Study: Three Households With $500K Net Worths

- The Minimalists (Age 32)

- Assets: 400K in ETFs, 400K in ETFs, 100K in home equity.

- Strategy: Geoarbitrage. They work remotely from Portugal, cutting living costs by 40%.

- Goal: Retire by 45 with $1.2 million.

- The Suburban Family (Age 48)

- Assets: $250K 401(k), $250K 401(k), $200K home equity, $50K cash.

- Stress Point: College tuition ($120,000 total for two kids). Considering a HELOC to cash-flow costs.

- The Pre-Retirees (Age 62)

- Assets: 300KIRA, 300KIRA, 150K paid-off condo, $50K emergency fund.

- Plan: Delay Social Security until 70 for maximum payouts ($3,822/month). Use IRA for healthcare gaps.

How to Reach (and Grow) $500K

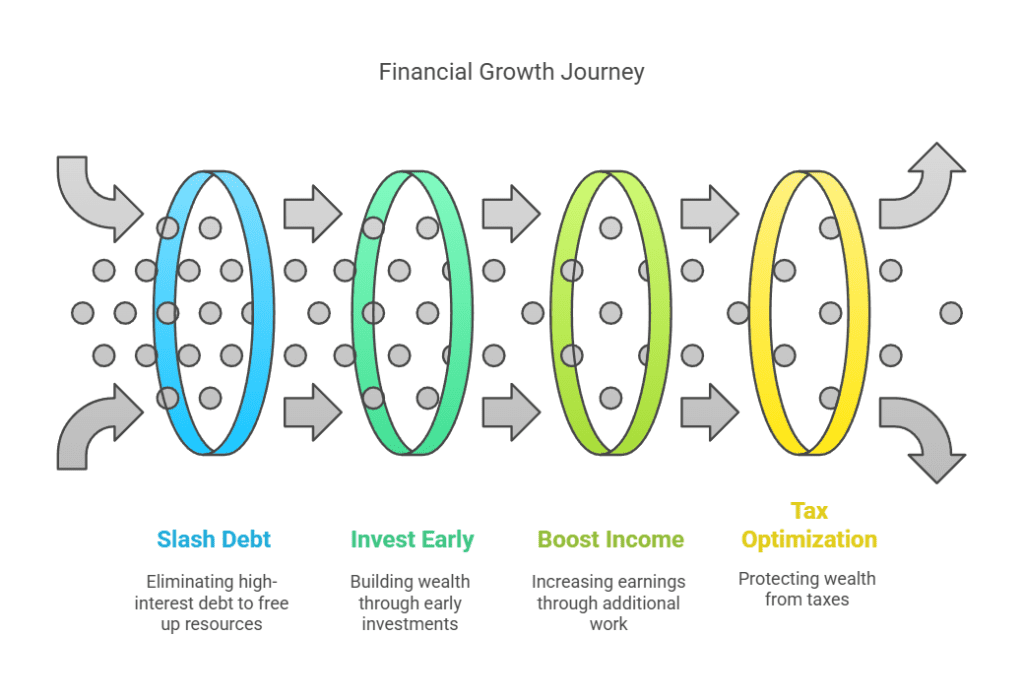

- Slash Debt: Refinance high-interest loans. The average credit card APR is 24.6%—paying this down is a guaranteed ROI.

- Invest Early: A 25-year-old investing $1,000/month at $71,000/month at $7,500K by 35.

- Boost Income: Side hustles add ~$1,122/month (Bankrate, 2023).

- Tax Optimization: Max out Roth IRAs and HSAs. Use IRS Free File tools to plan.

The Bottom Line: It’s a Launchpad, Not a Finish Line

A $500K net worth is undeniably a strong financial foundation. It offers security, flexibility, and peace of mind. But wealth is relative:

- For a 30-year-old, it’s a ticket to early retirement or entrepreneurial risks.

- For a 60-year-old, it’s a safety net requiring careful stewardship.

Final Takeaway: Celebrate the milestone, but keep pushing. As the National Bureau of Economic Research notes, consistent investing and frugality outweigh windfalls. Whether you’re at 100Kor100Kor500K, focus on progress—not perfection.

Want to calculate your net worth? Try Our Net Worth Calculator for a detailed snapshot.